Provident Fund

Pooled funds under

management of UOBAM

(Thailand)

Pooled funds under management of UOB Asset Management(Thailand) Co., Ltd. are Master Pooled Fund under which the fund members are allowed to select investment plan that matches with their risk appetite and retirement goal, varied by age, investment horizon, investment knowledge, expected return or acceptable risk level.

UOBAM (Thailand) offers the following master pooled funds:

1. UOB Investor Choice Registered Provident Fund

2. UOB Master Fund Registered Provident Fund

1. UOB Investor Choice Registered Provident Fund

A master pooled fund with carefully constructed seven pre-defined allocations to three underlying mutual funds which represent each core asset class. Fund members are able to select one of the seven investment plans, or as per the condition that the fund committee set forth in the fund regulation. The fund won the 6th Provident Fund Award 2017 “Pooled Fund – fund size less than 10,000 Million Baht” from The Securities and Exchange Commission, Thailand (SEC)

UOB Investor Choice Registered Provident Fund

- Domestic Money Market: TCMFPVD*

- Domestic Fixed Income: TFIFPVD*

- Domestic Equity: TEF*

- Global Short-Term fixed income: UFFF-I*

- Global Fixed Income: USI*

- Global Equity: UESG*

- Global Balanced Fund: UGBF-N*

- Global Mixed Fund: UIFT

- Global Equities: UGFT

*TEF, UGBF-N, UFFF-I, USI, UESG are mutual funds that have a tax burden from investing in debt instruments for the fund's liquidity.

2. UOB Master Fund Registered Provident Fund

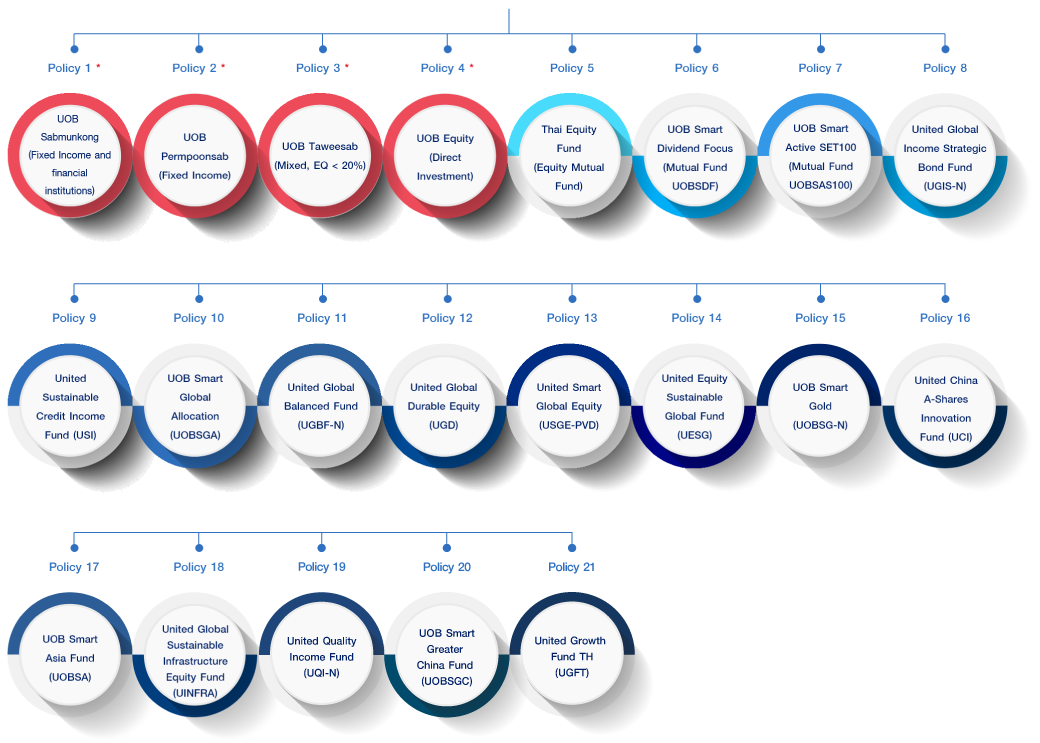

Another master pooled fund with a variety of investment policies, which either invest directly in financial instruments or via mutual funds. The fund committee determines the investment options to be made available to the fund members, or allows the members to freely choose a desired mix of investment policies by themselves (Do It Yourself: DIY).

UOB Investor Choice Registered Provident Fund

* Remark : Investment Policy 1-4 = direct investment Other Investment Policy = invest through mutual funds