Provident Fund

- Overview

- Services

- Products

- Credentials

- PVD Update

- PVD Fact Sheet

- Risk Profile

- Downloads

- Calculator

- Contact

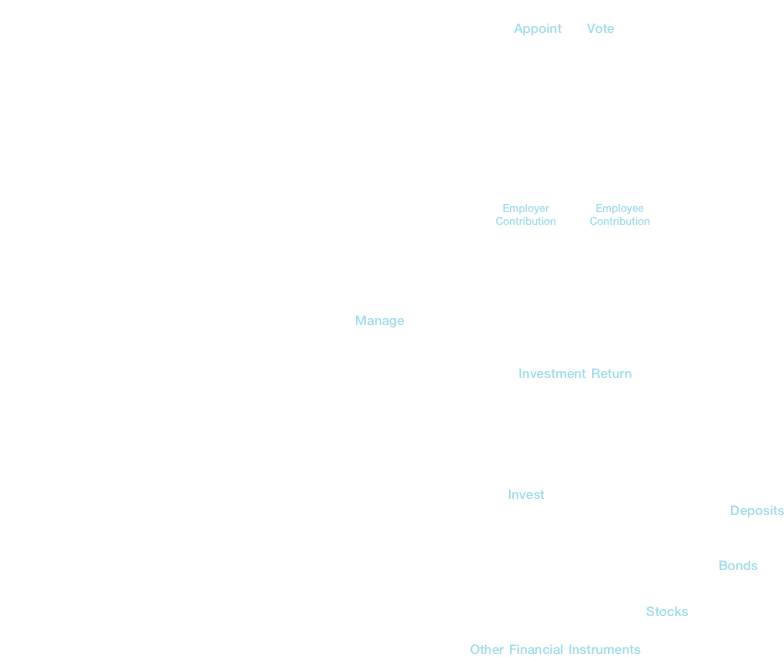

Related Parties to Provident Fund

* Remark

- Representatives of the fund

- Appointed by employer & voted by members

- Fiduciary duties

- Licensed by SEC

- Investment management of the fund

- Approved by the SEC

- Third-party financial institution

- Keep custody of fund assets

- System for contribution receipt and payment of the fund

- Member registrar system

- Minimum system requirement under guideline of SEC

Type of Provident Fund

- Generally, there are two types of provident fund. A “single fund” is a provident of an employer or a group of companies or conglomerate with initial outlay of THB 100 million or more, whose fund structure and investment policies being tailored to specific needs. On the other hand, a “pooled fund” is a provident fund opened for different companies to participate and take advantage of economy of scales by pooling the money from various entities under the same pooled fund.

Single Fund

Pooled Fund

Fund size

> THB 100 million

< THB 100 million

Expenses

Burden to the fund

Shared across employers

Decision making

Independent

Collective

Investment Policy

Tailor made. Multiple fund choice capacity depends on fund size.

Can be adjusted but requires majority votes. Flexible multiple fund choice platform

Single Fund

Fund size

> THB 100 million

Expenses

Burden to the fund

Decision making

Independent

Investment Policy

Tailor made. Multiple fund choice capacity depends on fund size.

Pooled Fund

Fund size

< THB 100 million

Expenses

Shared across employers

Decision making

Collective

Investment Policy

Can be adjusted but requires majority votes. Flexible multiple fund choice platform

Benefits

Pooled funds under management of UOBAM (Thailand)

Pooled funds under management of UOB Asset Management (Thailand) Co., Ltd. are Master Pooled Fund under which the fund members are allowed to select investment plan that matches with their risk appetite and retirement goal, varied by age, investment horizon, investment knowledge, expected return or acceptable risk level.

UOBAM (Thailand) offers the following master pooled funds:

- UOB Investor Choice Registered Provident Fund

- UOB Master Fund Registered Provident Fund

1. UOB Investor Choice Registered Provident Fund

A master pooled fund with carefully constructed seven pre-defined allocations to three underlying mutual funds which represent each core asset class. Fund members are able to select one of the seven investment plans, or as per the condition that the fund committee set forth in the fund regulation.

The fund won the 6th Provident Fund Award 2017 “Pooled Fund – fund size less than 10,000 Million Baht” from The Securities and Exchange Commission, Thailand (SEC)

Underlying mutual funds:

-

Thai Cash Management Fund: TCMF

Invests in deposits and/or short-term fixed income instruments of government, state enterprise, and/or private sectors. - Thai Fixed Income Fund: TFIF

Invests in deposits and/or fixed-income instruments of government, state enterprise, and/or private sectors. - Thai Equity Fund: TEF

Invests in stocks with sound fundamentals, strong earnings, and growth potential for not less than 65% of NAV

UOB Investor Choice Registered Fund

Plan 1

Plan 2

Plan 3

Plan 4

Plan 5

Plan 6

Plan 7

Other

Fixed Income

Fixed Income 90%

Equity 10%

Fixed Income 80%

Equity 20%

Fixed Income 60%

Equity 40%

Fixed Income 40%

Equity 60%

Fixed Income 20%

Equity 80%

Equity

2. UOB Master Fund Registered Provident Fund

Another master pooled fund with a variety of investment policies, which either invest directly in financial instruments or via mutual funds. The fund committee determines the investment options to be made available to the fund members, or allows the members to freely choose a desired mix of investment policies by themselves (Do It Yourself: DIY).

UOB Master Fund Registered Provident Fund

Plan 1 *

Plan 2 *

Plan 3 *

Plan 4 *

Plan 5

Plan 6

Plan 7

Plan 8

Other

UOB

Submunkong

Submunkong

UOB

Permpoonsab

Permpoonsab

UOB

Taweesab

Taweesab

UOB

Equity

Equity

Fixed

Income

(no corporate

bonds)

Income

(no corporate

bonds)

Fixed

Income

Income

Mixed,

Fixed Income 80%

Equity 20%

Equity

Equity via UOB

Smart Dividend

Focus

Smart Dividend

Focus

Equity via

UOB Smart

Active SET

UOB Smart

Active SET

Global Allocation

via UOB Smart

Global Allocation

via UOB Smart

Global Allocation

Alternative

Investment via

UOB Smart Gold

Investment via

UOB Smart Gold

* Remark :

Investment Policy 1-4 = direct investment

Investment Policy 5-8 = invest through mutual funds

Consulting service on fund establishment

Provide consulting service to working team/fund committee on fund structure

Provide consulting service on planning and execution of fund registration and preparation of required documents

Provide suitability analysis in determining appropriate investment plans

Provide consulting service on fund regulation formulation to ensure that it is in accordance with related laws and aligned with the needs of employer and employees

Prepare documents and execute fund registration and filing with registrar

Provident Fund Registration

Sponsoring employer and employees who are interested in setting up provident fund may refer to the following process:

Entire registration process takes

approximately 30 days.

approximately 30 days.

Choose

UOB Asset Management

UOB Asset Management

Complete RFI

template and

return to UOBAM T - 30

template and

return to UOBAM T - 30

UOBAM received online registration

form from SEC and return related

documents to sponsoring employer for signatures T - 25

form from SEC and return related

documents to sponsoring employer for signatures T - 25

Document signed by

authorized signatories

returned to UOBAM T - 20

authorized signatories

returned to UOBAM T - 20

Employee communication session

provided by UOBAM T - 15

provided by UOBAM T - 15

UOBAM forward completed

documents to SEC for

approval T - 10

Before effective date

documents to SEC for

approval T - 10

Before effective date

SEC approve fund participation

T = Effective date

(payroll date)

(payroll date)

Sponsoring employer remits

1st contribution to the fund

within 3 working days after

payroll date Contribution remittance

within 3 working days after payday

1st contribution to the fund

within 3 working days after

payroll date Contribution remittance

within 3 working days after payday

Member Education Service

- Provide education on provident fund basics as well as multiple fund choice training

- Provide education on basic investment literature, risk-return tradeoff, and investment plan selection

- Provide education materials to be distributed to the employees without extra charge

Online Services

Individual provident fund balance enquiry online

Investment plan switching online

Information updates such as economic/investment outlook online

Forms download for both fund committee and fund members

Reports for fund committee and fund members

1. Monthly Reports

- Kor Chor 1.1 report - statement of employee and employer portions and earnings

- Kor Chor 1.2 report – details of net asset

- Fixed-income investment report

- Details of member accounts

- Monthly provident fund summary report

2. Annual Reports

- Kor Chor 2.1 report – balance sheet

- Kor Chor 2.2 report – income statement

- Kor Chor 2.3 report – details of investment

- Kor Chor 2.4 report – statement of change in net asset

- Kor Chor 2.5 report – statement of cash flows

- Kor Chor 2.6 report –important financial notes

Why UOBAM Provident Fund?

International Expertise

- UOB Group support on various investment management aspects

- UOB Group research and study

Solid foundation and excellent management

- Active investment management

- Good governance and rigid audit and compliance

- Online services for individual balance enquiry as well as fund switching

Investment management team with local and international expertise

- Proficiency in money market and capital market

- Long-standing experience in fixed-income and equity investment

- Pioneer in new product innovations

Member Risk Profile

It is advisable that fund committee allow fund members to select investment policy by themselves to suit with their risk preferences which could be influenced by age, investment horizon, investment knowledge, expected return, acceptable risk level.

As a result, the Member Risk Profile is designed to assist the fund members in evaluating their risk preference and selecting the suitable investment policy. By law, this form shall be updated once every two years by the individual fund members.

Download

UOBAM Provident fund News Update

Fund Manager Investment Views and inform from UOB Asset Management (Thailand) Company Limited

Investment Outlook

Manage your personal portfolio with recommended mutual funds

Manage your post-retirement portfolio

Contact Provident Fund Department

UOB Asset Management (Thailand) Co., Ltd.

Contact UOBAM Provident Funds

Tel : +66 2786 2000 ext. 2031 - 5

Fax : +66 2786 2371

Fax : +66 2786 2371

Email

[email protected]

Address

23A, 25th Floor, Asia Centre Building,

173/27-30, 31-33 South Sathon Road, Thungmahamek, Sathon, Bangkok 10120, Thailand

Tel : +66 2786 2000

173/27-30, 31-33 South Sathon Road, Thungmahamek, Sathon, Bangkok 10120, Thailand

Tel : +66 2786 2000

Interested in Provident Fund